MyGreenBucks Kenneth Jones: The Visionary Behind Sustainable Finance

Financial literacy and sustainable investment have become vital in establishing long-term economic stability. Kenneth Jones identified this need and established MyGreenBucks to bridge the gap between personal money management and environmental responsibility. This website not only offers financial tools but also incorporates sustainability into its fundamental objective, steering users toward eco-friendly investment options.

Kenneth Jones: The Visionary Behind MyGreenBucks

Early Life and Education

Kenneth Jones has a significant expertise in finance and technology. He received a degree in Finance and then pursued an MBA, arming himself with the competence essential to innovate inside the financial industry. His early career comprised employment at top financial institutions, where he received hands-on knowledge in investing techniques and wealth management.

Professional Milestones

Under Jones’ stewardship, MyGreenBucks has seen tremendous milestones such as:

- FORBES – 30 Under 30, FINANCE: Pioneered environmentally-friendly digital banking.

- UserBase Growth: Crossed 5 lac active users, demonstrating its mass acceptance.

- Financial Impact: Average savings for users increased by 32% indicating the effectiveness of the platform.

Learn more about Kenneth Jones on Forbes

The Genesis of MyGreenBucks

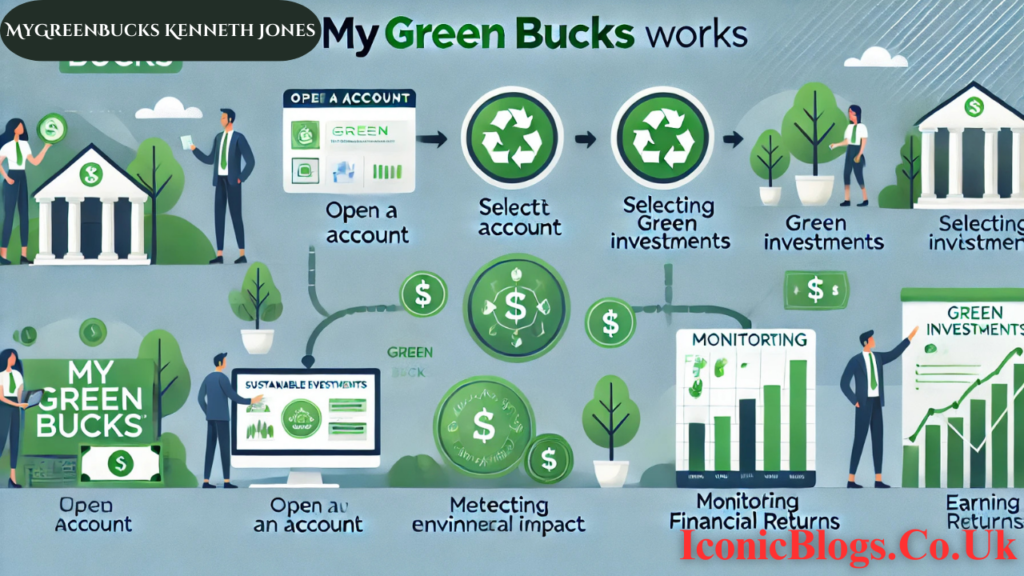

MyGreenBucks was established to democratize financial services through technology. Kenneth Jones identified gaps in digital banking accessibility and created a user-friendly platform integrating AI algorithms for personalized financial guidance. The platform leverages blockchain technology for enhanced security while maintaining FDIC compliance.

Core Mission

The mission of MyGreenBucks is to empower individuals and businesses to make financial choices that benefit both their wallets and the planet. Through education, innovation, and collaboration, the platform encourages users to support green initiatives while improving their financial well-being.

Visit MyGreenBucks Official Website

Features of MyGreenBucks

1. Opportunities for Investment in Sustainability

The user can choose investments in sustainable projects — like wind energy and green agriculture — that resonate with their idea of the world.

Customized financial planning

Because of this, financial advisors and accountants can utilize this platform to ensure their plans take into consideration my romantic desire, my individualistic aspirations, and my sustainability efforts.

Educational Resources

MyGreenBucks provides access to a wealth of educational resources, such as articles, videos, and webinars, to help users improve their financial literacy and understanding of sustainable finance.

Advanced Analytics

Leverage analytics that track how financial decisions impact our planet, showing users how their investments contribute to a decrease in carbon footprints and support for social impact.

Impact on Sustainable Finance

MyGreenBucks has been a major player in advancing the sustainable finance through:

- Use case of NFT: Raising awareness in sustainable finance.

- (RED) Facilitate Green Investments: Allow people to invest in projects that benefit the environment.

- Promoting Corporate Accountability: Spurring other financial institutions to sustainable practices

Case Study: User Success Story

Sarah, a MyGreenBucks user, transitioned from traditional banking to this sustainable platform. Within a year, she restructured her investment portfolio to include renewable energy projects, resulting in both financial returns and personal satisfaction from contributing to environmental preservation.

Pros and Cons of MyGreenBucks

Pros:

- User-Friendly Interface: Simplifies complex financial concepts for all users.

- Comprehensive Resources: Offers a wealth of educational materials.

- Sustainable Focus: Aligns financial growth with environmental responsibility.

Cons:

- Learning Curve: Users new to sustainable finance may require time to fully utilize all features.

- Market Risks: As with all investments, there are inherent risks involved.

Read about all the Frequently Asked Questions (FAQs)

Q1: What exactly is the MyGreenBucks mission?

Q1: What is the mission behind sustainable personal finance?

Q2: What measures does MyGreenBucks take to protect user data?

A2: As mentioned, we use blockchain and other specialized technology, like privacy chains, to maintain a high level of anonymity and security on our user information and transactions.

Q3: How does MyGreenBucks help a newcomer in finance?

A3: Yes, MyGreenBucks offers user-friendly financial education and investment tools designed for various levels of expertise.

Conclusion

Kenneth Jones has introduced MyGreenBucks to change the financial landscape to one centered around sustainability and strategic investing. The platform provides users with the knowledge and tools to make financial decisions that are beneficial to both their wealth and the world.

AlsoRead: Dorothée Lepère: A Detailed Insight into the Life of the French Businesswoman